Understanding the Self-Employment Work Visa. Spain is a vibrant hub for innovative entrepreneurs seeking a thriving workplace. With the recent tax changes brought by the Beckham rule, the Self-Employment Work Visa is your gateway to this dynamic environment, offering the perfect blend of temporary residence and the chance to launch or expand your business ventures in Spain and the European Union.. Whether your passion lies in tech innovation, culinary arts, or creative industries, this visa is the crucial first step to expand your business to Spain.

As a result of our experience establishing successful businesses in Spain, Del Canto Chambers has developed a profound understanding of the processes involved. With our unique turnkey project management approach, navigating legal complexities or embracing cultural nuances, we ensure that moving to Spain is both rewarding and seamless.

The Spanish Self Employment Visa is regulated in Ley Orgánica 4/2000 and the Real Decreto 557/2011 on foreigners’ rights and liberties in Spain and further explained by the Ministerio de Asuntos Exteriores, Union Europea y Cooperación. To ensure a successful application, every step must be carefully considered, not just translated.

Eligibility Criteria

We have summarised the specific prerequisites to be considered:

- The applicant must be a non-European Union citizen.

- They cannot be in Spanish territory illegally.

- A clean criminal record should be held in Spain and the previous countries of residence for the past five years.

- Entry Requirements: Ensure you aren’t banned or blocked from entering Spain.

- Legal Compliance: Gather a list of the authorisations and licences required to initiate your business. Specify the status of the application procedures and include any certificates obtained from the respective regulatory bodies.

- Professional Qualifications: Having the right professional qualifications or having solid documented experience in your field is essential for meeting this requirement. Additionally, if being a part of a professional association is required to practise that specific profession in Spain, you should also be a member of that group.

- Investment and Job Creation: Show that your planned investment is substantial and has a positive impact.

- Fees: Pay the necessary fees for processing the temporary residence authorisation and the authorisation for self-employed work.

Documentation Required

The application process necessitates the submission of the following documents:

- Completed and signed application form (EX–07).

- A copy of a valid passport.

- Retail and Listed Services (Up to 750 sq. m): Submit a simple declaration for smaller retail setups, like shops under 750 sq. m. Also, include proof of tax payment if needed.

- Other Activities and Professional Services: List and provide the status of required licences or authorisations for your planned business or professional service.

- Professional Qualifications: Include a copy of your qualifications and any needed credentials for practising your profession in Spain.

- Investment Sufficiency: Show documents proving your investment is enough for your project and its impact in Spain.

- The last two sections (5 and 6) can be validated through an assessment report from one of the following organisations:

- Federación Nacional de Asociaciones de Empresarios y Trabajadores Autónomos (ATA)

- Unión de Profesionales y Trabajadores Autónomos (UPTA)

- Foreign documents must be legalised or apostilled and submitted with an official translation into Spanish.

Application Procedure

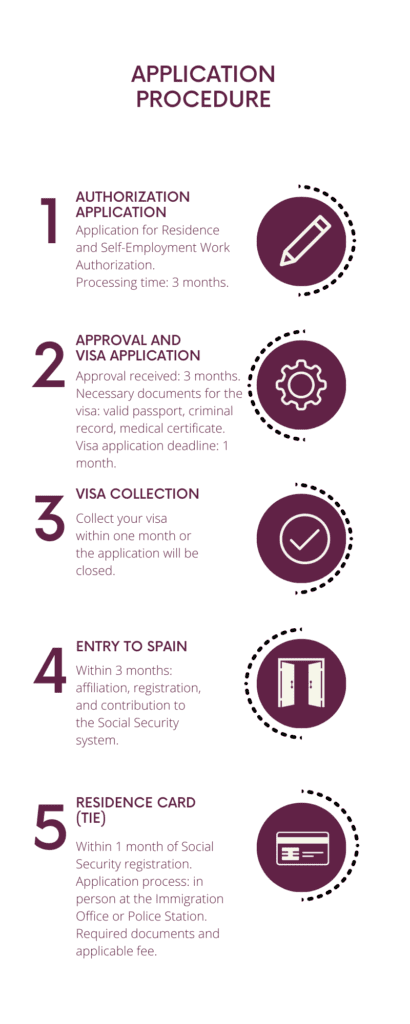

Del Canto Chambers, on behalf of the applicant, must submit a residence and self-employment work authorisation to the Spanish Consulate. If no response is received within three months, it may be considered a rejection. After approval, the applicant has one month to apply for a visa, providing necessary documents such as a valid passport, criminal record, and medical certificate. The application is closed if the visa is not collected within a month of notification.

According to Spanish law, a visa holder has three months from entry to complete their affiliation, registration, and contribution to the Social Security system.

An applicant must apply for a residence card (TIE) within one month of registering with Social Security, providing the necessary documents, and paying the required fee at the Immigration Office or Police Station in the province where the authorisation was processed.

Navigating the Self-Employment Work Visa process requires careful adherence to these steps and documentation to ensure a smooth transition to becoming self-employed in Spain. With our help, you will be guided through every step and easily handled during the transition to self-employment in Spain. Once you’re set-up, you can trust Del Canto Chambers’ local offices in Palma, Ibiza, Madrid, Barcelona, Marbella, and Coruña for all your legal, Social Security, Tax, and accounting needs, so you can focus on what you do best: growing your business.

Article prepared by Sara Velasco. Sara is a senior lawyer with several years of experience assisting clients moving to Spain. Call her at +44 2070 430648 or contact us here, and we will get back to you within 24 hours.