Acquiring A Spanish Company: The Due Diligence Process. Here’s some good news if you’re considering purchasing a Spanish company. The economy grew more than expected in the first quarter, a sign of resilience as inflation eased at the beginning of the year. Spain is predicted to avoid a recession. Sectors experiencing significant growth are services and tourism.

Regardless of your business, undertaking comprehensive due diligence checks is a vital part of the purchasing process. You must have a complete picture of the business’s legal, financial, commercial, and organisational state before you hand over tens or even hundreds of thousands of euros. This article explains a proprietary Due Diligence Process based on Del Canto Chambers’ M&A experience.

Before diving deep into Del Canto Chambers’ Due Diligence Process, let us briefly remind you of the necessary aspects of the acquisition in Spain, which do not differ from those in other jurisdictions.

Five key milestones to Acquiring a Spanish Company

Once you have agreed on a target, reviewing the entity’s legal structure resulting from the operation is fundamental. It may be done with a Limited (SL) or Public (SA) company, and Luxemburg or the Netherlands must be considered for Holding purposes. At this point, a dual-qualified tax lawyer must be involved to draft a comprehensive tax & legal report on the acquisition and structures to be used, from a Spanish point of view, as the company types differ from the UK or the USA in terms of governance, liability, and compliance. Financials, accounting, and tax rules must also be taken into account.

The five key milestones to acquire a Spanish company, as in any other jurisdiction, are:

- Agree a Memorandum of Understanding or send a Letter of Intent (sometimes referred to as a non-binding Indicative Offer)

- Sign a Confidentiality Agreement or NDA and agree on the process of disclosure

- Complete the Due Diligence Process

- Complete the negotiations for the Transaction

- Sign an Acquisition Agreement (Sales and Purchase Agreement)

In subsequent articles, we will examine steps one, two, four and five.

What due diligence is needed when buying a company in Spain?

Due diligence is an investigation into all elements of a business to unearth any potential risks that may affect the value or validity of the entity in the future. It can also unearth opportunities that may not be immediately apparent.

The due diligence process can help you to:

- Evaluate the strengths and weaknesses of the business.

- Ensure you are paying the right price and provide negotiating points.

- Identify any risks that may affect how the deal needs to be structured.

- Identify if any third-party consent is required to move the purchase process forward.

- Establish where warranties and indemnities need to be put in place.

- Provide an in-depth business profile to see any processes you need to implement immediately after purchase (for example, changing a particular supplier).

What are the essential due diligence checks when acquiring a company in Spain?

Financial Information

- Financial statements (balance sheet, income, and cash flow statements) for the past three years

- Details of any loans or other debts owed by the company

- Gross profit for the business’s products and services

- Gross margins analysis

- Projections, strategic plan, and capital budget

- Capital structure

- All non-operating expenses

- Actual vs projected sales chart

- A list of the company’s assets and liabilities

- Unrecorded liabilities

Legal Information

All the following contracts/information must be reviewed:

- Leases (equipment, vehicles, premises)

- Commercial property information

- Purchase agreements

- Incorporation documents

- Trademarks, copyrights, and patents

- Distribution agreements

- Sales contracts

- A list of all possible or pending litigation

Marketing

- Past and present marketing strategies

- Results from the recent marketing campaign

- Marketing trends

- Marketing ROI

Market Analysis

- The business’s target customers and their demographics

- Competitors

- The geographic economic outlook

- Perception of the brand

Industry trends

- Has the business grown over the past five years?

- Perform a SWOT analysis

- Competitor products, deals, and market share

Products and Services Information

- What are the company’s products and services, and which are profitable?

- Desired future improvements to the products or services

- Warranty claims related to the products

Employees

- What is the employment structure?

- Who are the current employees, their positions, qualifications, and earnings?

- Future staffing needs

- Are there any contractors?

- Policies related to time off, holidays, and remote working

- Employment contracts (including benefits and commission structures) and the staff handbook

- Any employee share schemes

Customer Information

- Who are the customers, and does the company retain them?

- How much does it cost to acquire a new customer?

- What is the customer satisfaction rate?

- Has the business lost any major customers over the past two years?

Tax Information

- Historical tax returns for the past five years

- The company’s tax structure

- VAT registration

- Employment tax filing

- Documents supporting tax settlement over the past three years

- All tax liens

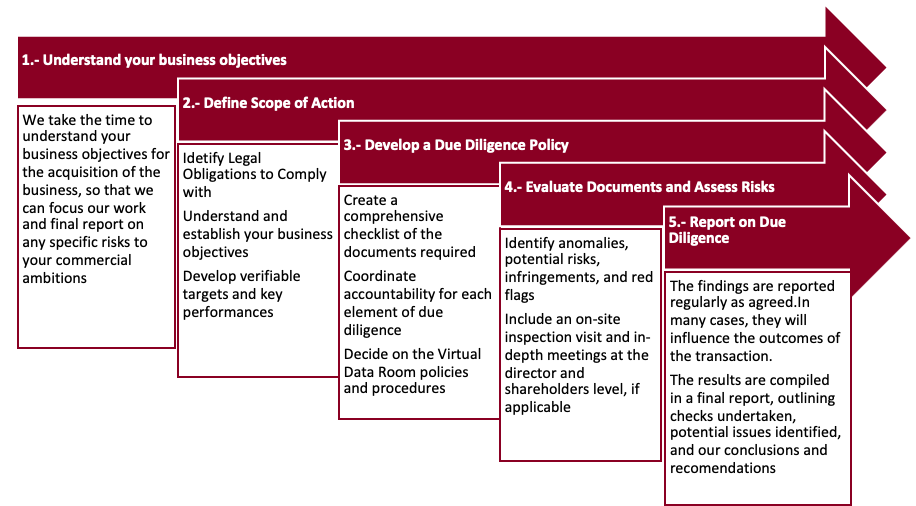

Del Canto Chambers’ Due Diligence Process

Del Canto Chambers has established a thorough and systematic process to conduct due diligence efficiently and effectively.

Del Canto Chambers’s Due Diligence Process consists of five Phases:

An expert Project Management Team including Project Administrators, Corporate, IP, Data Protection, Tax and litigation lawyers, and HR and Financial experts, leads Del Canto Chambers’s Due Diligence Process. Many members of our team are legally qualified in two or more jurisdictions and are bilingual in English, Spanish, Catalán and Gallego. When undertaking due diligence for clients purchasing a business in Spain, our Team will:

- Establish the process and protocols for Due Diligence between the acquisition and target company, from agreeing on the Data Room system to be used down to site visits.

- Ensure that onsite visit impact is minimised and managed effectively.

- Support the M&A professionals to meet the key objectives of the transaction.

- Evaluate the deal’s financials, identify anomalies and risks, and provide information to assist you with the various negotiations associated with any M&A deal.

- Identify any potential litigation, regulatory investigations, and tax issues.

- Deep dive into the target company’s commercial contracts, including agreements/licences with IT providers, customers/clients, and suppliers, and identify potential risks.

- Undertake an HR analysis and identify any employee-related risks, such as unsettled grievances or potential employment law claims.

- Analyse the target company’s intellectual property and communicate any unprotected IP assets and potential infringements.

- Report on domestic and international regulations that could impact the target’s current and future value and threaten the deal.

- Monitor confidentiality and PR of the deal.

- Examine the target’s tax structure and report on the effect this will have on achieving the deal’s strategic objectives and the company’s future profitability.

Our dual-qualified, multilingual legal team can advise and undertake all the due diligence required when purchasing a business in Spain. Please contact us at +44 207 043 0648 to make an appointment.

Please note that this article does not constitute legal advice.