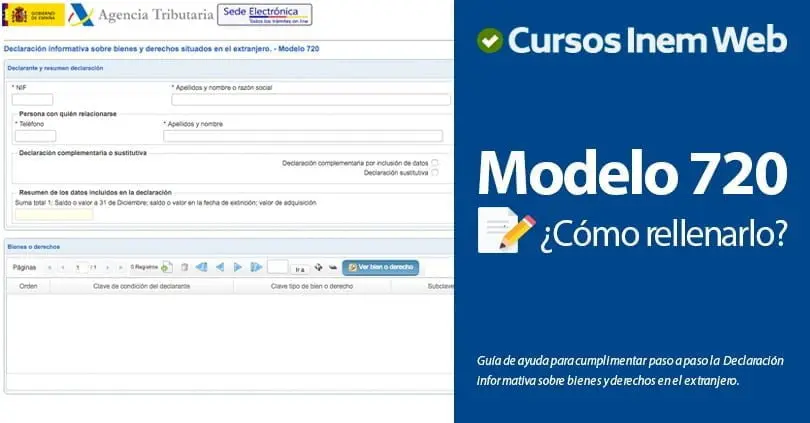

720 form is in question

720 form is in question. This infamous and abusive Spanish Tax Form 720 has been now declared contrary to the free EU movement of capital. The EU Court of Justice

720 form is in question. This infamous and abusive Spanish Tax Form 720 has been now declared contrary to the free EU movement of capital. The EU Court of Justice

Gibraltar tax agreement with Spain. What does the tax agreement between Spain and Gibraltar mean for you? Gibraltar is not just a rock. The city is a special place, with

Form 720, an illegal form?. The Supreme Court of Justice rules in favor of a taxpayer with a property abroad and condemns to the Spanish Tax Office for the sanctions

Spanish tax investigation. Taxes are just a fact of life, wherever you live. In fact, sometimes, the luckier you have been in life, the more worried about taxes you must

Taxation of spanish residence. Sun, food, chances for relaxation, affordability… All of these and even more are invaluable elements that contribute to an accomplished life are present in Spain. Many

British expats living in Spain: are their rights at stake?. Hundreds of thousands of British expats living in Spain face increasingly unfavorable tax burdens and discrimination over their pre-Brexit immigration

Taxation of Spanish Property. One of the most common concerns for British and other expat residents in Spain is their property taxes. How many taxes are there? When are they

Owning Spanish property via an international company. Previously, we have the reviewed the history of property ownership through companies in Spain. The structure emerged in the last decades of the

Owning property with a company in Spain: a tax time-bomb. Owning Spanish property via an international company could be a tax time-bomb waiting to explode. Spain has for decades been

Taxation of british pensioners in Spain: British citizens applying for pensions while living in Spain: before and after Brexit implementation time. It is hard to trivialise the issue of pensions

In accordance to the Bar Standards Board, we hereby inform you that you may contact us for a quotation.