Driving in Spain: you may have an embargo and you don´t even know about it

Driving in Spain: you may have an embargo. You may visit Spain for a couple of days or you may just have moved there to live a simpler, sunnier life.

Driving in Spain: you may have an embargo. You may visit Spain for a couple of days or you may just have moved there to live a simpler, sunnier life.

The Spanish tax office’s (Agencia Tributaria – AEAT) Annual Tax and Customs Plan for 2021 is paying closer attention to international expatriates based on expenditure patterns and travels. Spain’s tax

Hiring a legal professional is a tricky decision, particularly when one needs an urgent opinion on financial or fiscal and tax matters.

The Spanish Administration is famous for the excessive formalities and its red tape. One of those famous formalities is coming soon and it comes in the form of, surprise, surprise:

Living in Ibiza and paying the right taxes. Property Taxes and Legal issues in Ibiza – non-Spanish residents living in The Balearics Islands need to be aware of Spanish legal

British residents in Spain after Brexit. Ever since the referendum in 2016, British and European press outlets were full of predictions and prophecies about the outcomes of the vote. From

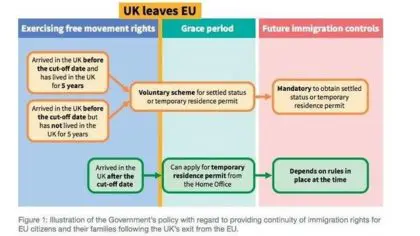

Spanish and EU residents in the UK after Brexit. In the previous post about the European Union settlement scheme, established by the United Kingdom’s Withdrawal Agreement, we reviewed the timing

Spanish and EU residents in the UK after Brexit. Brexit will involve a lot of changes that are sometimes discussed with generic terms like trade relations or border agreements. However,

If you have purchased an off-plan property in Spain before the 1st of January of 2016, this might be your last chance to claim back your deposit and other amounts

Justice on the Costa Del Sol. Mortgage contracts on Spanish properties have been a headache for British borrowers for some years now, due to the abusive nature of Spanish bank

New High Court ruling will force the Spanish Tax Authorities to be better behaved. Let’s say you are being treated by a doctor with a specific drug just before having

Guide to dealing with probate. Dealing with probate after the death of a loved one has never been an easy procedure. Covid-19 has made it more challenging and the need

Wealth tax: a small tax for such a big debate. As the government considers the country’s economic position following the Covid-19 pandemic, calls are being made for the implementation of

Spanish residence permit for British Citizens after Brexit. The British exit from the EU on January the 31st seems like a lifetime ago, as the events of recent months have

Spain’s back to normal, slowly but surely. It is three months since the lockdown began and there has now been some lifting of restrictions in Spain’s reopening plan. Starting 21st

On the 4th March 2019 a new tax treaty was agreed between the UK and Spain regarding Gibraltar and this could have serious implications for anyone with connections to Spain.

The Spanish inpatriate system (the Beckham Rule) post Covid-19. As a consequence of the Covid-19 health crisis global immigration has fallen, and the property market is suffering with a substantial

Spanish Inheritance Tax Considerations for “Brexpats”. With Brexit underway, U.K. residents who own property in Spain—of which there are many, considering Spain is one of the top overseas destinations where

The #coronavirus crisis requires constant monitoring of our tax obligations, both in England and Spain. In Spain, despite the situation, the Council of Ministers, in its meeting yesterday, did not

The Brexit Prophecy and “Brexpats” in Spain. Brexit is here and all seems very normal. Brexit will be completed as a result of the U.K. elections—the fulfillment of a prophecy,

Sting in the tail for Spanish property buyers. It was recently reported that over 5,000 properties in Spain are owned by international investors, the majority of which are UK residents.

The Brexit Prophecy and “Brexpats” in Spain. International tax barrister Leon Fernando Del Canto looks at what Brexit will mean for businesses and individuals in the EU and in particular

Spanish Tax Authority Looks at Foreign Property Owners. International tax barrister Leon Fernando Del Canto discusses the growing interest of the Spanish tax authorities in ownership of properties through international

Spain cracks down on ‘aggressive tax planning. “There are more than 5,000 private Spanish properties valued at over £1m owned by foreign investors, most of which are UK residents. The

Understanding tax on your Spanish holiday home If you aren’t a resident of Spain, you may struggle to understand the Spanish tax you need to pay on your holiday home.

How does Spain tax corporate income? Individuals operating their own business or planning a startup in Spain will need awareness of the Spanish tax system in order to succeed. Del

Tax planning for Spain. It’s always been important to get the right tax planning. Whether you are talking about UK tax, Spanish tax or any other form of international tax

The Supreme Court condemns the Spanish Tax Office. The Supreme Court of Justice of Castilla y León has admitted the appeal of a taxpayer that had been sanctioned a total

Spain remains the most popular destination for British expats retiring overseas. Spain is also hosting the largest group of UK citizens living in the rest of the EU at an

What we save by working with full invoice. According to VAT law, for a purchase document to be considered a full invoice it has to meet various requirements, some of

The claims service of the Bank of Spain has been overwhelmed by consumers making complaints against lenders for abusive mortgage interest floor clauses, and set-up costs. The Claims Service of

International company structures established in decades gone by to help wealthy owners of property in Spain avoid tax are now a ticking time-bomb as the Spanish tax authorities set their

As we announced in our last article, the New Spanish Law for contractors and freelancers reforming Self Employed conditions came into force on the 1st of January 2018. These are some

Since its promulgation, Spain has joined countries that aim to attract residents of great fortune. Has the Beckham law helped to attract foreign capital? There is currently an international struggle

Many of yours might be thinking, whether at this stage, would be worthy to apply for a Permanent Residence Card or perhaps would be convenient to wait until the UK

PAST: The Federation for self-employed workers (ATA) had long called for an ambitious reform of the self-employed statute for recovering a very punished sector. According to its president, 2 out

Recently we published an article with regards to court claims in mortgage expenses (Notary fees, Land´s Registry fees, Property Appraisal and management costs among others). Furthermore, a First Instance Judge

In the past seminar called Protección del consumidor en la contratación hipotecaria (Consumer Protection in mortgage contracting) that took place in Santander from 19 to 21 July, the notaries are

Spain will incorporate to its legislation the Directive 2014/17 CE of 4th February 2014 on credit agreements for consumers relating to residential immovable property. It means that banks will have

It’s just a matter of time that UK expatriates in Spain receive a notification from the Spanish Inland Revenue (Hacienda); claiming unpaid taxes for the last four tax years (tax

Regarding the costs of the trial Paying legal costs even if having good chances for winning a case against banks, may be deterrent rather than effective and may prevent consumers from

In this article, Antonio Gabriel Aguilera talks about, the so-called “floor clauses” and explains that it is a current and unstoppable phenomenon affecting millions of clients in the whole Spanish

If you are one of those that are doubting about starting a complaint for overcharged mortgage interest against your bank, probably, many doubts will arise before contacting a professional firm.

Now, time is essential for a successful reclaim of your off-plan property deposit. One of every five houses bought by foreigners in Spain, belongs to British Buyers; however, some

Touristic Lettings in Andalucía: What should we know about… Touristic Lettings are significantly increased during the Summer. If you are one of those thinking about renting your property for touristic

Gibraltar and its tax regime: more complexity in the negotiations of the Brexit Spain and the United Kingdom disagree on where to approach Gibraltar’s future fiscal status, whether within the

Capital gain, cadastre and taxes increase the final price of housing by 25% The calculation of the municipal surplus value and the increase of the value of the land by

Gibraltar calls for more support against interference from Spain and the EU The Gibraltarian authorities ask the British government and the party of Theresa May for a greater commitment from

The Home Office changes the EEA (PR) Guidance Notes After media published that the Home Office tries to stop the applications to Permanent Residence Card from EEA citizens suggesting to

Floor clauses: Also a nightmare for British residents in Spain It is estimated that around 200.000 British residents in Spain own properties with mortgages containing floor clauses that could be

The Spanish Embassy in the UK will resolve Spanish residents’ Brexit’s doubts The Spanish Embassy in the United Kingdom has opened a single window to resolve the Spanish residents’ doubts

The Spanish Embassy held a meeting on Brexit “This is a historic moment from which there can be no turning back” said yesterday Theresa May in the House of Commons;

ISA Accounts: Effortlessly Save (tax) in the UK Individual Savings Accounts (ISA) are a very popular savings model in the UK. The fiscal will implement in April new fiscal measures

Application for UK Residence Card A popular Spanish proverb says “All fields bloom in March…”. March is the month in which we begin to awake from the winter lethargy and

All the Fields Bloom in March… El refranero popular dice que “en Marzo florecen en todos los campos..”, sin duda es el mes en el que comenzamos a salir del

Higher Education and Visa Requirement in Spain for International Students Spain offers a variety of higher education choices. Students come from different countries to study in one of the seventy

Del Canto Chambers: Universal jurisdiction and self-regulation to tackle tax fraud Our Managing Partner, León Fernando del Canto, has published an opinion piece in the Financial Instruments Tax & Accounting

Del Canto Chambers: fight against tax avoidance is key to restore confidence in tax system Our Managing Partner, León Fernando del Canto, has published a piece in the journal Bloomberg

Self-employed workers and SMEs, with more margin to defer their debts with the Spanish Tax Agency SMEs and self-employed workers will be able to defer their debts and tax payments

Del Canto Chambers considers like a “smokescreen” the floor clauses’ extrajudicial process Our Managing Partner, León Fernando del Canto, has published an opinion article in the journal Huffington Post in

Schengen after Brexit Refugees crisis and spread nationalism across Europe have questioned the third-countries visa rules in the Schengen Area, but the real test will be the Brexit that will

The British government eases the inheritance tax regime Real estate wealth in the UK tends to concentrate generationally. The difficulties of young people’s access to this market influence their taxation.

Del Canto Chambers bets for Spain as British housing investments’ destination Our Managing Partner, León Fernando del Canto, has published statements in the British magazine Expat Network in which he

04-01-2017 | EXPAT NETWORK Our Managing Partner, León Fernando del Canto, has published statements in the British magazine Expat Network in which he highlights that Spain, despite Brexit and the

Del Canto Chambers advocates for the tax advisors’ leadership on the fight against fraud Our Managing Partner, León Fernando del Canto, has published an opinion piece in the Spear’s magazine

Del Canto Chambers apuesta por la “jurisdicción universal” también para delitos fiscales Our Managing Partner, León Fernando del Canto, has published an opinion piece in the magazine Spear’s in which

2-12-2016 | SPEAR’S Our Managing Partner, León Fernando del Canto, has published an opinion piece in the magazine Spear’s in which he defends the application of the universal jurisdiction principle

Del Canto Chambers advises British expats to comply their taxation duties in Spain Our Managing Partner, León Fernando del Canto, has published a statement in the magazine Silver Surfers in

Madrid’s High Court contradict the Spanish tax authority’s criteria and it recognizes the refund of income taxes paid on maternity leave. The Community of Madrid’s High Court of Justice (TSJM)

Our Managing Partner, León Fernando del Canto, has published an article entitled “Gibraltar: the yardstick of the future of Spanish and British relations” in The Barrister Magazine, where he analyses

17-11-2016 | THE BARRISTER MAGAZINE Our Managing Partner, León Fernando del Canto, has published an article entitled “Gibraltar: the yardstick of the future of Spanish and British relations” in The

The Spanish tax authority keeps its collection policy and it is focused on HNWI and multinationals, increasing its inspections in areas like Costa del Sol and Madrid The Spanish Tax

The World Economic Forum places the UK among the most competitive economies. The United Kingdom is the seventh most competitive economy worldwide. This has been confirmed in the report by

The 31st of October marks the end of the Spanish Tax Agency’s Tax Inspection’s Intensified Action Plan against tax fraud, which has been described as arbitrary and confiscatory by the

The economic journal “Cinco Días” has published an opinion piece by our Managing Partner, León Fernando del Canto, in which he explains what a living will is and why it

Qatar, United Kingdom and #Apple kept us occupied at Del Canto Chambers this week At Del Canto Chambers, September has started with an interview in The Times regarding the #AppleTax

León Fernando del Canto on The Times: “Direct tax is a sovereign responsibility of individual EU states” The British journal The Times has published some statements of our Managing Partner

People deciding to get a living will increase each year in Spain, although it still is a legal resource used by a minority of people in our country. The number

Seven of the ten most profitable investment funds in Spain exceed 20 points in cost effectiveness in relation to the amount invested A curious paradox takes place in the market

Gibraltar, especially in the context of Brexit, is set out to be an important player in the field of Family Offices. Its tax regime is not the only advantage; its

HMRC has an ambitious plan against tax evasion that is raising doubts among industry professionals and tax advisors. The British Treasury has launched a plan to prevent tax fraud which

The existing legislation between Spain and Britain regarding inheritance is complex, mainly because their legal traditions are opposed. While in the UK there is absolute freedom in regards to how

27-07-2016 | CINCO DÍAS The Finance Newspaper, Cinco Días, published a column by our Managing Partner, Leon Fernando del Canto, on inspection activity of the Tax Authorities in Costa del Sol,

Tax authorities reveal more than one and a half million non-declared properties in Spain. Its impact on immovable property’s tax collection it is a lifeline for councils’ accounts. The Spanish

The Turkish government is completing in its parliament a tax amnesty to attract assets Turkey in the last years is conducting an adaptation process to international common standards on transparency

British pensioners on abroad have experienced how their pensions have dropped until a 10% and they are afraid of losing even more purchase power. The Brexit still has consequences, mostly

The Brexit’s effects and those caused by the CJEU’s Advocate General’s line on mortgage-floor-clauses in the Spanish banking sector fill our first week up. Lawfirm Del Canto Chambers’ blog started

In London and in the rest of the European continent the strategies to avoid Brexit’s negative consequences and to take advantage of its opportunities are being redefined. The Brexit’s economic

They told us their worries about the prospect of Brexit, now the UK has voted for it Britain’s workers share their reaction. Europeans living in the UK have expressed alarm

This week in London I noticed how Spanish gastronomy, music and fashion is going mainstream again. I am not talking about cheap paella, tacky folklore music or flamenco dresses. I

A recent press release from the Consejo General del Poder Judicial (General Council for the Judiciary) reports an interesting ruling of the Spanish Supreme Court. The decision, of 19 June

An article in The Guardian by Simon Bowers reports that ‘the island should be ready to become independent, says senior minister after political attacks on finance industry.’ The full article

In the Volokh conspiracy blog, the question about marriage being a contract is asked. He responded “I thought I’d respond to this on-blog because it illustrates a considerably broader point:

The average tax burden on earnings in OECD countries continues to rise Published in OECD Tax News – 25/04/2012 25/04/012 – The average tax and social security burden on employment

UK Tax Budget 2012 – The Association of Taxation Technicians has produced a Special Report on the March Budget in their April 2012 Newsletter. The full Report is detailed below: The contents of

As discussed in a number of previous Tax Alerts from www.venable.com, since 2009 the Internal Revenue Service has created three separate tax amnesty programs in order to encourage U.S. taxpayers

The Madrid Regional Administrative Tax Court (known as “TEAR”) in a decision dated 29 November 2011 (notified on 27 December 2011) acknowledges the application of EU Law over previous discriminatory

Audits are more frequent and aggressive, and thus more costly to defend or litigate; assessments and penalties have now entered the realm of billions of dollars; and companies face unprecedented

In 2008 the Spanish Government chose to ‘eliminate’ wealth tax by applying a 100% exemption, instead of derogating the law. On 17 September 2011 the wealth tax was reintroduced by

In accordance to the Bar Standards Board, we hereby inform you that you may contact us for a quotation.