Form 720, an illegal form?. The Supreme Court of Justice rules in favor of a taxpayer with a property abroad and condemns to the Spanish Tax Office for the sanctions of Form 720

Relocating to Spain for business or pleasure is a very appealing prospect for many; however, it comes with obligations. One of the most controversial duties for foreign citizens who are officially residing in Spain is the Modelo 720 form (hereafter, 720 form). The 720 form refers to assets held abroad by these residents. Completing the form is actually a very important duty. Missing the deadline for reporting overseas assets to Spanish tax authorities can lead to steep fines. While the future of the form itself is in question, as it will be reviewed below, it is important for any tax resident to be aware of its content and timings.

In fact, with the full arrival of Brexit in 2021, it will be more common for British citizens to become visible for tax authorities. In the past, free circulation within the European Union, among other benefits, allowed many British individuals to engage in day-to-day life in Spain without worrying about residency status. This will of course change and, increasingly, British expats will seek to confirm their right to remain in Spain. Before they start enjoying their life in the sun, therefore, they should pay attention to the 720 form, a little-known but vital administrative process. Ignoring it can lead to disastrous consequences, as experienced by Spaniards and non-Spaniards alike.

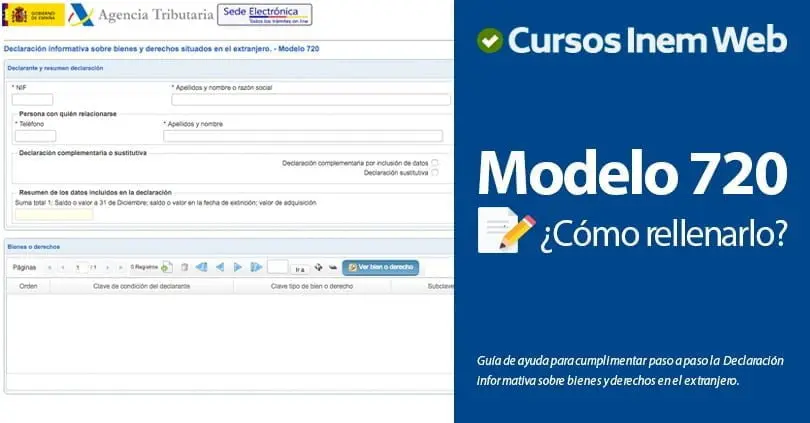

The Modelo 720 form: what is it and when to submit it

Tax residents in Spain must report any of the following assets held abroad, and the 720 form is the informative tool to do so. There is no payment involved, but it can be time-consuming. Still, are there ways to avoid it?

You could be exempt if you are technically not a tax resident in the country. Again: the 720 form is only required of those who are considered tax residents in Spain. This means that not everyone will have to submit it. You are a tax resident in Spain if:

- You spend 183 or more days in Spain within the same year (even if you have not registered as a taxpayer).

- Your job is in Spain, whether self-employed or hired by a company.

- Your key “interests” live in Spain; this chiefly refers to dependent family members like children or a spouse.

- Additionally, depending on the post-Brexit regime, registering to become a resident with the right to remain in Spain will implicitly confirm your attachment and therefore tax residency in the country.

There is an additional exception to the 720 form related to the value of the assets reported. Reporting is only compulsory when the added value of any of the following assets surpasses €50,000:

- Bank accounts.

- Investments: annuities, securities, insurance, rights…

- Properties.

The individual in question must provide information when he or she is either the owner, representative, beneficiary or any other role in which it has any powers over the foreign asset. Even if the assets are held via a fiduciary, trust or firm, they must be reported. In the case of joint ownership properties or financial products, the value is considered in full; not pro-rated to percentage. For those assets managed by banks and similar organisations, it is important to provide an average balance of the account for the last 3 months of the tax year.

When in the year and how often does the taxpayer have to submit this 720 form to Spanish tax authorities?

- The first time you submit the 720 form you must do so between January and March within the relevant tax year.

- You do not need to file it a second time unless:

- Value of an asset grew more than €20,000.

- Any asset was sold, or a new asset bought.

Whatever the timings, however, it is important to conduct any submissions as soon or even before you have decided to permanently transfer your residency to Spain. You might think that ignoring the issue and living discretely, while fulfilling all your other tax obligations, might be enough to avoid scrutiny. This is assumption is no longer valid. This is because tax authorities across borders are increasingly sharing information about individuals and their assets, through reforms like the Modelo 298 that regulates communication between administrations across Europe. Taking care of the issue in advance, assisted by sound tax and legal professionals, will avoid undesired consequences.

The reason why you should consult with experienced transnational advisors, like those at Del Canto Chambers, lies in the many pitfalls and difficulties involved in completing the actual form. For example, even if bank accounts held abroad are empty of assets, they must be declared. Another challenge: the €20,000 change in asset value that justifies a re-submission of the form can be spread across assets. And what to do with firm ownership, particularly for shares of those which are private and not publicly listed? Spanish tax authorities have their own rules for assessing company valuations that might differ… In sum, the best way to complete the process with confidence is to check with experts, even if you can do it yourself electronically.

In fact, what are the risks of not submitting the 720 Form, making mistaks, or of submitting it late? Well, they are quite punishing.

The pain of not submitting the 720 form for assets held outside Spain

As with any other interaction with tax authorities, the best course of action is to be proactive and come clean. In the case of the 720 form, there are multiple fines you should worry about if you are planning on flying under the radar as an expat in Spain:

- €5,000 for every piece of information that is not submitted (from the categories listed above). €10,000 is the minimum fine paid if this omission is detected by the authorities.

- €5,000 for every piece of information that is not deemed accurate (from the categories listed above). €10,000 is the minimum fine paid if mistakes or deliberate inaccuracies are detected by the authorities.

- €100 for every piece of information on the form when it is submitted by post, rather than electronically. €1,500 is the minimum fine paid if the individual does not complete the electronic form.

- €100 for every piece of information on the form when it is submitted after the deadline and before it is requested by the Tax Authorities.

If this does not seem hard enough, there is more! Any assets not listed on the form that are later attributed to you will be added to your taxable base as an undeclared gain. This also applies to corporations and corporate tax. The sanction from regularising this undeclared income abroad consists in a penalty of 150% applied to the relevant unpaid tax. Surpassing more than €120,000 of evaded tax results in a criminal offence in Spain. In general, the authorities have generally applied fines of around €10,000 for British and other expats who have had problems with the 720 form.

Even if the Modelo 720 form is in question, British expats should still submit it

In today’s globalised economy, particularly in Europe, many taxpayers have acquired assets across borders. Since Spain is a popular destination for pensioners or self-employed individuals, it is common for them to not know this very specific rule and be surprised by huge fines. In Spain and abroad, there are many legal professionals who are increasingly uncomfortable with the Modelo 720 form.

In 2019, for instance, the Supreme Court of Justice of Castilla y León ruled in favour of a taxpayer who was fined €5,800 euros for missing the deadline. Spanish authorities were also instructed to cover litigation costs. However, the Spanish Supreme Court later corrected this ruling, by instructing that the penalty was proportional to the taxpayer’s mistake.

Possibly, the European Commission will be the one to finally eradicate the 720 form from Spanish tax law. In February 2017, for instance, the EU Commission concluded that Spain was not fulfilling obligations in the treaty, by imposing penalties on non-submission of information as if they were in themselves tax fraud. The issue is even greater, considering the lack of a statute of limitations on submitting information, which runs counter to European Union regulations. As a result, it is likely that the 720 form will be eliminated or reformed in the future.

In the meantime, nonetheless, British expats and any other foreign citizens who seek to relocate to Spain should keep completing the form. Indeed, the 720 form should not be considered in isolation and enter the picture as an element in overall tax planning. At Del Canto Chambers we are experienced in helping our clients to correctly submit the 720 form, and more. If you have recently moved to Spain, or even before you do so, we strongly advise you to contact us to understand your tax obligations. Make sure that your relationship with the Spanish tax authorities, and your asset distribution across borders, is as beneficial as possible.

Contact Us

Del Canto Chambers is a leading London Chambers specialising in commercial law and tax, both domestic and international.

We can offer you extensive advice and guidance in putting the right legal structure in place for your new business. Our legal experts can work with you throughout the life of your enterprise, ensuring that it has a sound basis and that all compliance issues are properly dealt with.

To make a no-obligation enquiry, please either call us now on:

+44 2070 430648 or Make An Online Enquiry.