Making a will in Spain (II)

Making a will in Spain (II). In the previous post about wills and inheritance in Spain, we discussed how the difference between the United Kingdom and the European Union context

Making a will in Spain (II). In the previous post about wills and inheritance in Spain, we discussed how the difference between the United Kingdom and the European Union context

Using a family investment company to pass on wealth. For families looking for a secure and tax-efficient way to manage and pass on wealth, a family investment company may offer

Intellectual Property: tax issues in creating, holding and disposing of IP. Dealing with the tax situation for your intellectual property (IP) can be complicated. Governments often apply tax benefits to

Making a will in Spain (I). Getting ready for the British exit of the European Union involves many administrative processes for individuals and companies, which are rapidly coming to terms

Gibraltar tax agreement with Spain. What does the tax agreement between Spain and Gibraltar mean for you? Gibraltar is not just a rock. The city is a special place, with

COVID-19 and the franchise landscape. Spain is one of Europe’s leading consumer markets, partly aided by its role as the second most popular tourist destination in the world. Franchisors have

The Lugano Convention: a matter of genuine concern for the UK. “As a consequence of leaving the EU, the UK lost its membership of the Lugano Convention, a relevant international

European Court of Justice new ruling on mortgage claims. There are many good things to be said about Spain, from its weather to its fantastic food and welcoming people. Sadly,

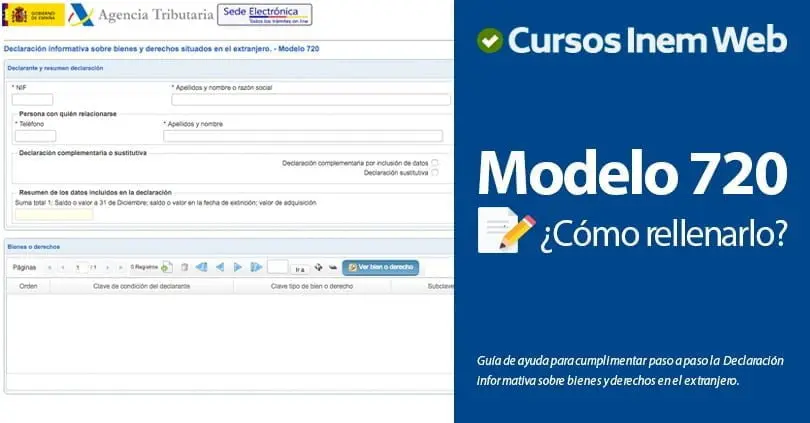

Form 720, an illegal form?. The Supreme Court of Justice rules in favor of a taxpayer with a property abroad and condemns to the Spanish Tax Office for the sanctions

Spanish tax investigation. Taxes are just a fact of life, wherever you live. In fact, sometimes, the luckier you have been in life, the more worried about taxes you must

In accordance to the Bar Standards Board, we hereby inform you that you may contact us for a quotation.